KUALA LUMPUR: In the prevailing low-interest rate environment and amid a lack of earnings catalysts, investors are likely to look out for defensive stocks that offer a high dividend yield in order to secure good returns.

This is especially so with the current fears surrounding the outbreak of the Wuhan virus which may have an impact on global economic activities, said analysts.

Hong Leong Investment Bank (HLIB) head of retail research Loui Low said investors should go for stocks with a high net cash position, high dividend yield and solid fundamentals and which would not be impacted by the virus outbreak.

This, he said, included stocks in the technology and telecommunications, construction, and power and utilities sectors.

With the fifth generation (5G) and National Fiberisation and Connectivity Plan that are being implemented in Malaysia serving as catalysts, the technology and telecommunications counters could be considered a defensive play, said Low.

Notably, DiGi.Com Bhd and Maxis Bhd have indicated dividend yields of 4.13% and 3.67%, respectively which are seen as relatively attractive.

Low said the construction sector is also his pick on the back of the anticipation of tender results from megaprojects and potential pump-priming activities by the government this year.

He said power-related stocks should be quite stable in this environment where there is a slowdown in economic activity.

TA Investment Management Bhd chief investment officer Choo Swee Kee pointed out that defensive stocks are suitable at all times for conservative retail investors.

“This is as defensive stocks are for investors who do not want high levels [of] risk, seek safety and yield certainty,” he said.

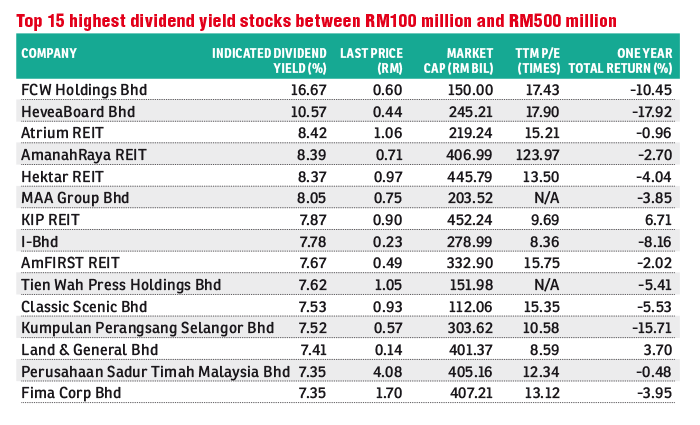

Most notable as defensive in nature with stable yields are the real estate investment trusts (REITs). Choo said investors should go for industrial REITs as well as those with assets that draw tourists.

“As you know, retail REITs are facing pressure and office REITs are facing an office glut. We like industrial REITs and REITs that have well-known assets that attract tourists,” he said.

Other than that, Choo highlighted dividend-paying stocks whose businesses are utility-based or concession-based as good picks in this environment. Typically these are businesses that have stable incomes.

He added that banks, while not always being defensive in nature, are defensive in today’s context.

“We think that the bad news for banks have [already been discounted] and banking stocks have gone down,” he said.

Malayan Banking Bhd, the country’s largest bank by market capitalisation, has a yield of over 6%.

Yields aside, the total returns of many banks’ shares have fallen over the past year.

Public Bank Bhd, for instance, saw its total return decline 23.9% over the year to RM18.34 last Friday. The counter had fallen to RM18 last Wednesday, a level that has not been seen since December 2016.

May not be so defensive after all

While some stocks may be deemed as defensive, this does not mean that they are automatically safe havens.

TA’s Choo said defensive stocks are still equity-based and thus will be impacted by investor sentiment, which to put it simply could be a double-edged sword.

“They (defensive stocks) are still equity-based, so they are subject to market forces. If something catastrophic happens and the market falls they can fall. In terms of upside, if market sentiment improves such stocks can also move upwards,” he said.

Rakuten Trade Research vice president Vincent Lau concurred, saying investors have to see whether a particular stock’s dividend yield is sustainable.

“While a counter may be able to offer high dividend yields at present, this does not translate into consistently high dividend yields,” he said, adding that if the US Dow Jones index registers significant declines, these declines can reverberate across to Malaysia-listed counters as the performance of such key indices can weigh on investor sentiment in Malaysia.

As seen in the past fortnight, the coronavirus outbreak has triggered a selldown in tourism-related counters. HLIB’s Low believes that the selldowns in the aviation, travel and hospitality sectors’ have already been priced in, and the affected stocks may see a technical rebound.

“However, should the financial results for these companies decline moving forward, then perhaps investors have to avoid them,” said Low, adding that a downside risk would be the delay in the implementation of the projects that are expected to spur the technology, telcommunications, construction, power and utility sectors.

Source: TheEdgeMarkets